— How the One Big Beautiful Bill Act Prioritizes Corporate Welfare Over Human Well-being

By | Nevada Chinese Perspective

In Las Vegas, thousands of workers rely on tips to survive. They are restaurant servers, casino bartenders, and hotel housekeepers—people who uphold the glamorous facade of the city, yet often struggle with unstable wages and unaffordable healthcare.

In July 2025, the U.S. Congress passed the sweeping One Big Beautiful Bill Act (OBBBA), which promises to “boost the economy,” “strengthen the border,” and “ease the taxpayer burden.” Among its touted provisions is the temporary exemption of tip income from federal income tax, which has been marketed as a major breakthrough for service workers in Nevada. However, many have overlooked a critical detail: this exemption only applies from 2025 to 2028.

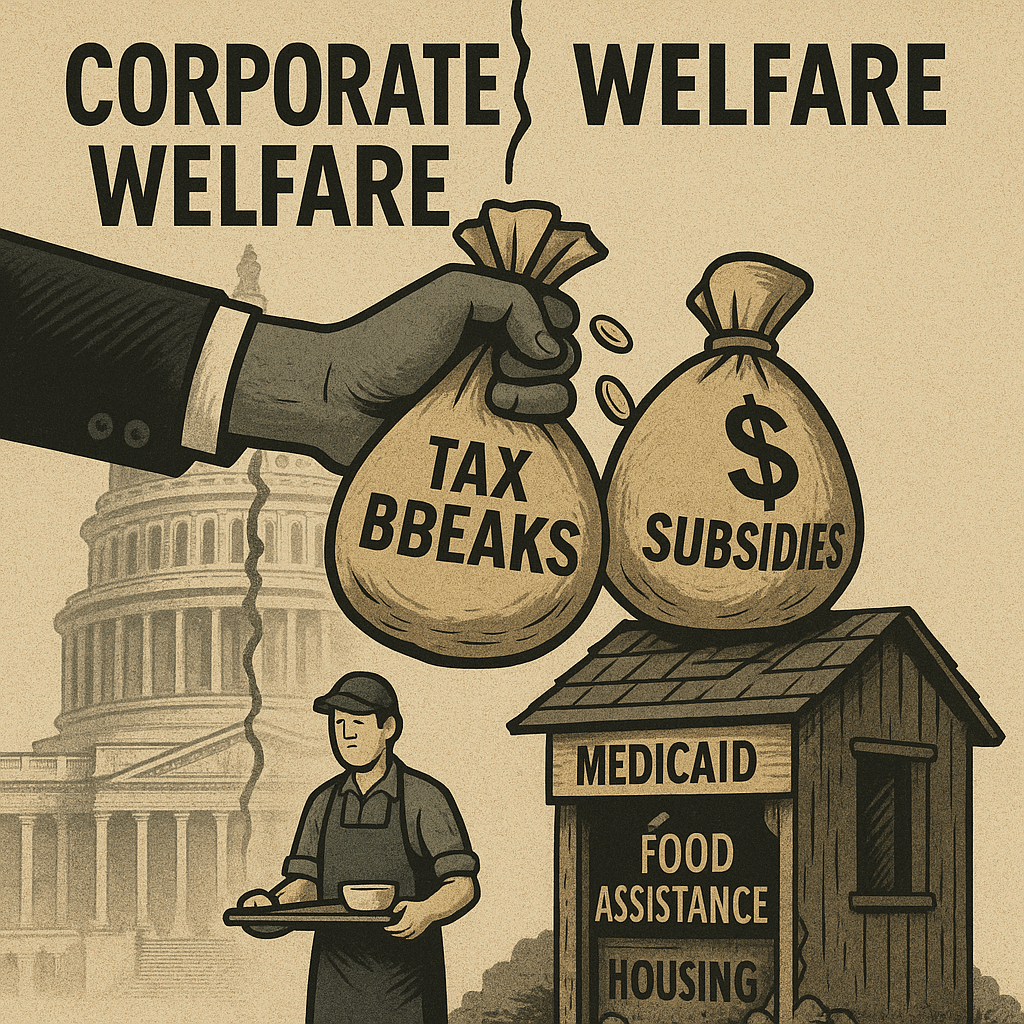

A closer reading of the full bill reveals a stark disparity in its funding priorities. On one hand, the legislation expands long-term corporate tax breaks and subsidies; on the other, it imposes deep cuts on essential programs like healthcare, food assistance, and housing aid.

This is not merely a technical budget reallocation—it marks a fundamental shift in the direction of national resource distribution. As the state with one of the highest proportions of tipped workers, Nevada stands at the forefront of this fiscal upheaval. We are witnessing the overwhelming replacement of “human welfare” with “corporate welfare.”

🏢 What is “Corporate Welfare”?

Corporate welfare refers to government policies that provide preferential treatment to businesses, including direct subsidies, tax exemptions, regulatory waivers, and favorable contracts. According to the Cato Institute, the federal government spends an estimated $181 billion annually on such benefits, with most concentrated in agriculture, energy, defense, broadband, and aviation.

The largest beneficiaries are not ordinary small businesses, but multinational corporations and high-income groups. A 2023 report by the Institute on Taxation and Economic Policy (ITEP) found that 84% of tax incentives go to the wealthiest 20% of Americans, with the top 1% taking nearly 30%. Moreover, 40% of corporate tax breaks ultimately flow to foreign investors.

In effect, “corporate welfare” has become synonymous with “welfare for the wealthy,” rather than fair support for employment, innovation, or small enterprises.

Significantly, many of the corporate tax breaks in OBBBA are long-term or even permanent. For instance, the 21% corporate tax rate has no scheduled expiration. Provisions like equipment depreciation, debt interest deduction, and the carried interest loophole remain intact—ensuring long-term benefits for wealthy investors and capital groups.

💰 Corporate Priorities in the OBBBA

Rather than correcting these imbalances, the One Big Beautiful Bill Act exacerbates them:

– It extends Trump-era tax policies, including low corporate tax rates, the carried interest loophole, and deductions for capital equipment and debt interest.

– It prioritizes funding for traditional industries like fossil fuels and defense contractors, while scaling back support for clean energy, small business innovation, and educational technology.

– It relaxes regulations and centralizes contracting power—cutting labor and environmental protections while easing bidding rules for large corporations.

The result is a concentration of public resources among already dominant capital groups—widening inequality and entrenching class divisions.

Meanwhile, benefits for everyday people are limited and temporary. The tip income tax exemption, for example, only applies from 2025 to 2028 and requires employers to report and verify earnings, making implementation burdensome. In contrast, benefits for the wealthy and corporations are stable, long-term, and clearly defined—intensifying systemic inequality.

👨👩👧 The Cost to Human Welfare

Compared to the generous benefits afforded to corporations, the cuts to the social safety net are glaring:

– Medicaid: Over $1 trillion in cuts, affecting more than 10 million people, including low-income families, seniors, individuals with disabilities, and local health systems.

– SNAP: Nearly $200 billion in cuts over ten years, expanding work requirements to adults aged 18–64 without dependents and removing exemptions for people aged 55–64, the homeless, and veterans.

– Other programs: Significant reductions in student loan forgiveness, elimination of clean energy tax credits, and funding freezes for reproductive and preventive health services.

Encouraging employable individuals to join the workforce is reasonable, but the new SNAP time limits lack flexibility and support mechanisms. They fail to account for the real challenges faced by older workers or single parents caring for children over age 14. Without employment support programs, such rigid eligibility requirements may ultimately undermine their own policy goals.

🚔 Enforcement First: ICE’s Rising Budget

In contrast to cuts in healthcare and food programs, the One Big Beautiful Bill Act significantly increases funding for immigration enforcement, particularly Immigration and Customs Enforcement (ICE):

– ICE’s budget has steadily grown, with the 2025 allocation approaching or exceeding $10 billion;

– The bill proposes investments in detention, deportation, and border control infrastructure, including new facilities, transportation, and expanded personnel;

– While no specific bed count or removal target is stated, the legislative language signals a shift toward more aggressive enforcement.

Compared to basic needs programs, ICE receives elevated priority in the budget. This reflects a value hierarchy: a willingness to invest in punitive infrastructure over restorative or humanitarian support. It raises fundamental concerns about how national resources are being aligned with enforcement rather than care.

⚖️ The Fiscal Scale Is Tipping

This redistribution—from public good to private gain—carries long-term consequences:

1. It accelerates wealth concentration and class immobility: permanent gains for the rich, while the poor face conditions, deadlines, and audits.

2. It erodes public trust and social cohesion: when essential protections are sacrificed, faith in government and civic participation declines.

3. It threatens fiscal stability: the bill is projected to add $2.8 to $4.5 trillion to the federal deficit, while permanent corporate tax cuts limit future flexibility.

Budgets are choices—and those choices reveal who is protected and who is sacrificed.

🧭 This Is Not Technical—It’s Moral

The federal budget is not just a technical document—it is a moral statement. As we continue to subsidize corporations, the wealthy, and immigration enforcement, while repeatedly cutting healthcare, food, and housing for working families, we are not responding to scarcity—we are choosing our priorities.

A truly sustainable society depends not just on individual effort, but on institutional fairness. The balance between economic goals and humanitarian protection is a defining test for any democracy.

Editor’s Note: This fifth article in the series is based on the text of the One Big Beautiful Bill Act, and data from CBO, ITEP, Cato Institute, USDA, ASTHO, and reputable media sources (AP, NPR, FT, The Guardian). Please cite the source if reprinted.

Discover more from 华人语界|Chinese Voices

Subscribe to get the latest posts sent to your email.