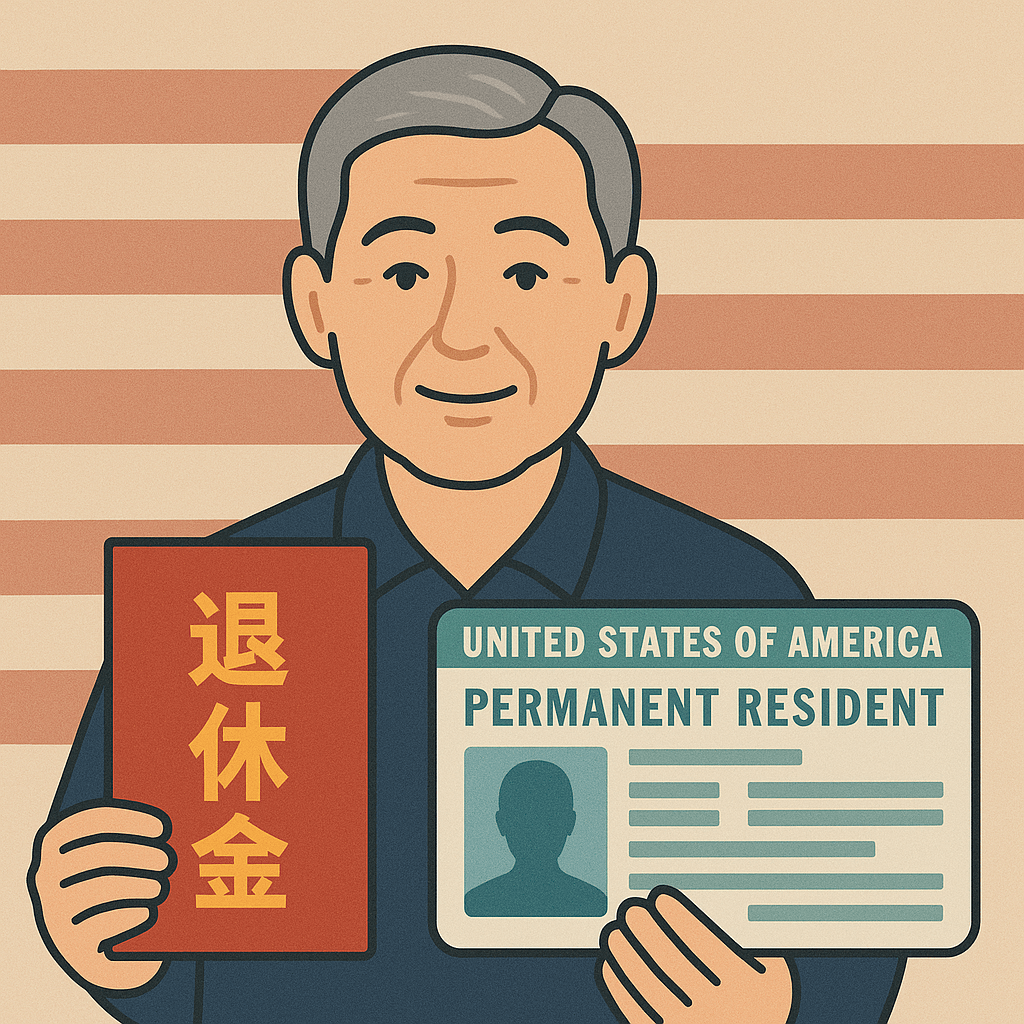

As more Chinese immigrants retire in the United States, a practical question arises: Many have contributed to China’s social security system for years—can they still receive pensions or retirement benefits from China? And if so, will that affect their U.S. green card status, or even lead to a loss of legal residency? This article clarifies these key issues.

Note: In this article, we primarily use the commonly known term “retirement pension” for ease of discussion. Technically speaking, “pension” refers to post-retirement income traditionally provided directly by employers or the government, while “social security pension” refers to benefits distributed through the national social insurance system. Today, these concepts have largely merged under a unified pension system.

⸻

1. Will Receiving Retirement Benefits from China Affect My Green Card?

First and foremost, receiving retirement or pension benefits from the Chinese government will not directly affect your U.S. permanent resident status. These benefits are considered rightful entitlements earned through legal employment and social security contributions in China. They are not categorized as “public benefits” or “public charges” under U.S. immigration law.

However, the real issue is not “receiving money,” but whether you continue to demonstrate the “intent” and “actual behavior” of residing in the United States. These factors are central in determining whether you have abandoned your green card.

⸻

2. When Could This Lead to Immigration Issues?

Problems may arise if, while receiving retirement benefits, you live in China long-term, lack a stable residence in the U.S., fail to file U.S. taxes consistently, or only return to the U.S. briefly each year. In such cases, even if you hold a green card, immigration officers or border agents may suspect that you have abandoned the U.S. as your primary residence.

There is no fixed number of days that defines abandonment under immigration law, but generally, being outside the U.S. for more than six months at a time—especially more than one year—or having a clear life base abroad increases the risk.

Furthermore, when applying for naturalization, U.S. Citizenship and Immigration Services (USCIS) will assess whether you have met the residency requirements over the past five years. Long-term residence in China, even while lawfully receiving benefits, could result in denial of your application due to insufficient physical presence.

⸻

3. What’s the Difference Between Chinese Social Security, Pension, and Retirement Benefits?

In China, “social security” is a broad term that includes pension insurance, medical insurance, unemployment insurance, and more. Pensions or retirement benefits usually refer to the regular payments one receives after fulfilling the required contribution period to pension insurance—a component of the social security system.

Many Chinese immigrants who held formal employment in China contributed to the system for 15 years or more and are entitled to receive these benefits upon retirement. These payments are considered earned income from prior contributions and do not constitute welfare; thus, they do not affect your U.S. immigration status.

⸻

4. Practical Tips: How to Avoid Immigration Risks

If you plan to receive Chinese retirement benefits while maintaining your U.S. green card, consider the following precautions:

– Ensure you spend sufficient time in the U.S. each year. Avoid long absences (especially over six months).

– Maintain ties to U.S. life, such as bank accounts, tax records, health insurance, and a residential address.

– If you anticipate an extended stay in China, apply in advance for a Re-entry Permit to demonstrate your intention to retain residency.

– If you plan to apply for U.S. citizenship in the future, ensure your U.S. physical presence and intent to reside are well documented.

⸻

Conclusion

Receiving retirement benefits from China is a rightful result of years of work and contributions, and it does not conflict with holding a U.S. green card. However, the crux of maintaining your green card lies in whether the U.S. remains your primary residence.

If you’re entering retirement or planning your later years, understanding these details and organizing your travel and residency records wisely can help you enjoy cross-border retirement benefits while securing your U.S. immigration status.

⸻

For more information on Re-entry Permits, tax obligations, or personalized immigration planning, consult a qualified immigration attorney. We will continue to explore similar topics in upcoming articles—stay tuned at ChineseVoices.org (search ‘ChineseVoices’ to find our site).

(By One Voice)

Discover more from 华人语界|Chinese Voices

Subscribe to get the latest posts sent to your email.